A Breather, Not a Breakdown

November 17, 2025

We all need a break occasionally. Sometimes you push so hard that your body and mind just yell, “That’s enough—we’re checking out for a bit.” Markets are no different. The S&P 500 and NASDAQ 100 have been running hard from the April lows.

There’s been plenty of uncertainty around tariffs, government shutdowns, interest rates, and whatever the drama du jour may be. It makes sense that the market would take a breather now—especially if it’s setting up for a year-end run.

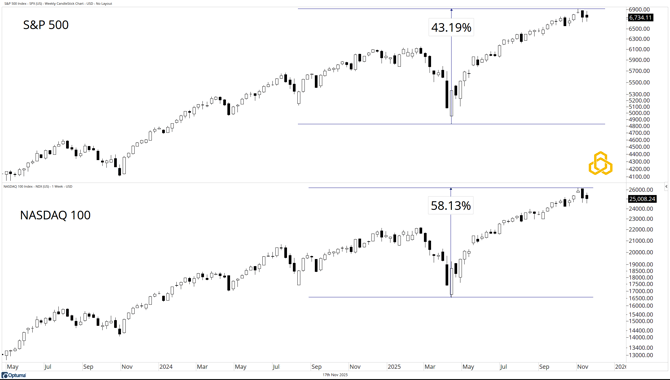

S&P 500 & NASDAQ 100 (Weekly)

As mentioned above, the U.S. equity market has put in a strong showing from the April “Liberation Lows.” From trough to peak, the S&P 500 rallied more than 43%, while the NASDAQ 100 added more than 58%.

Both are entitled to a rest.

Source: Optuma

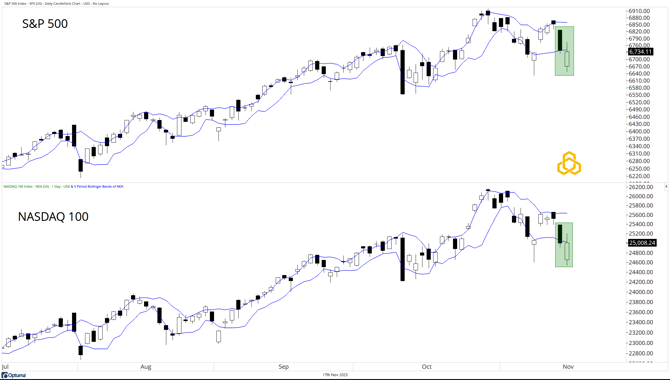

S&P 500 and NASDAQ 100 (Daily)

Last week, we highlighted that both the S&P 500 and NASDAQ 100 were oversold within their respective uptrends. We also noted that odds favored a short-term bounce—and that’s exactly what played out. After multiple closes near/below the lower Bollinger Band, both indices gapped higher last Monday and followed through on Tuesday and Wednesday morning.

Entering the new week, that setup could be in play once again.

Source: Optuma

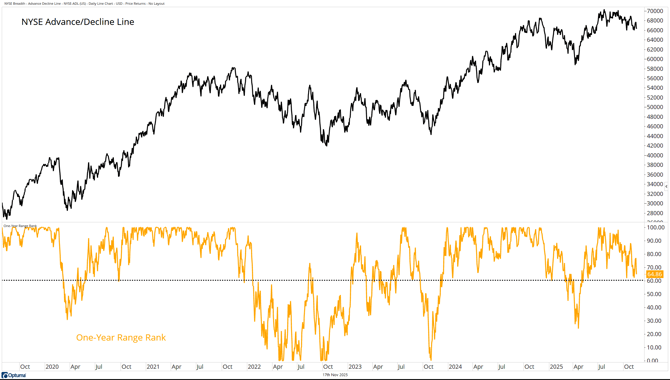

Breadth

The NYSE Advance/Decline Line remains in a small divergence but has not yet broken down to the point where odds of deeper equity declines are elevated. The one-year range rank remains above 60%.

Source: Optuma

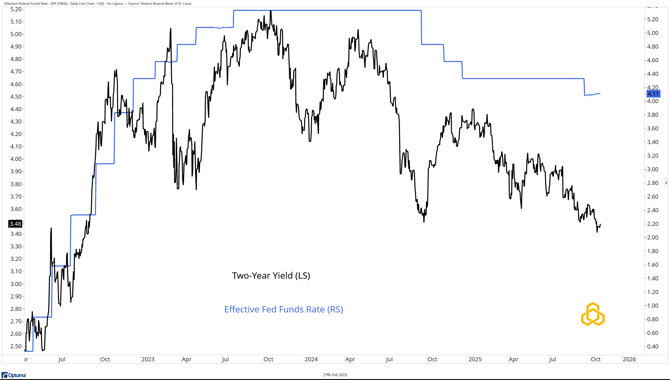

The Fed

We mentioned uncertainty above. There’s always uncertainty in the market. I don’t have a crystal ball—and I haven’t met anyone who does. However, we know the Fed is in play here. They’ve given us two rate cuts so far, and the market is looking for a third before year-end. Will we get it? The government has been shut down, and data flow has been light.

As of now, there’s a 30-basis-point spread between the Effective Fed Funds Rate and the Two-Year Yield. So it seems the market is looking for one more cut. After that? No one really knows.

Source: Optuma

Final Thoughts

After a powerful rally from the April lows, a pause is natural—and healthy. Short-term oversold conditions have already produced a bounce, and the setup for another move higher remains intact.

Breadth is stable, and the Fed still has room to cut. For now, this looks more like a breather than a breakdown.

Dan Russo, CMT

READ ALL RESEARCH BY POTOMAC CONTENT HERE.

Disclosure:

Potomac Fund Management (“Potomac”) is an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. Potomac does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Potomac website or incorporated herein, and takes no responsibility for any of this information. The views of Potomac are subject to change and Potomac is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-346-20251117