Buy the Rumor, Sell the News?

September 8, 2025

The Federal Reserve is meeting this week. A rate cut is almost a certainty—market-implied odds are around 92% for three cuts by year-end. The only real question is how many cuts we’ll actually see.

Now, we can debate whether these cuts are warranted. After all, the S&P 500 is at all-time highs, junk bonds are at all-time highs, semiconductors are at all-time highs… you get the point. I’ve written about all of these in past notes.

Given this backdrop, you must ask yourself: What would surprise the market?

I could venture a few guesses, but that’s not what we do here. The data and the trends will answer that question for us. If you want to pin me down, the biggest surprise would be fewer than three cuts by December.

Rates

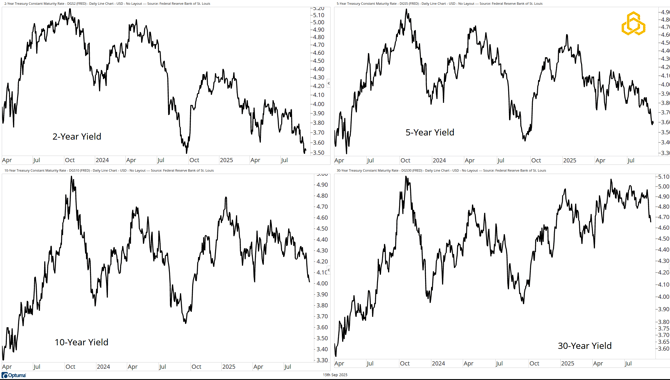

Interest rates are falling across the curve—from 2s to 30s. The recent trend is clearly to the downside. In other words, there’s little reason to believe we won’t see a cut this week.

Source: Optuma

Inflation Expectations

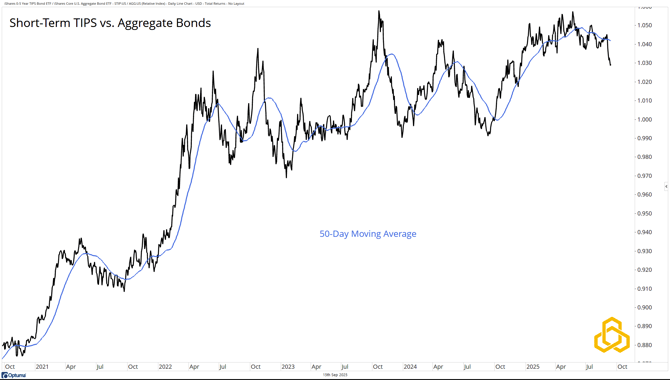

In past notes, we’ve discussed how the 2-Year Yield has been trading well below the Effective Fed Funds Rate, giving the Fed “air cover” to cut. Additional cover comes from inflation expectations. The ratio of the iShares 0–5 Year TIPS Bond ETF (STIP) to the iShares Core U.S. Aggregate Bond ETF (AGG) has broken lower after failing to make a new high in May. In short, investors are becoming less concerned about inflation.

Source: Optuma

S&P 500

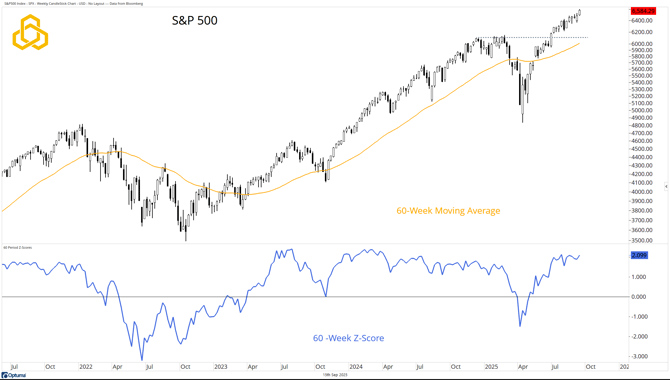

For the fifth time in six weeks, the S&P 500 closed higher—well above the rising 60-day moving average and the key 6,100 level. Note the use of the word “well.” The current 60-week Z-score for the index is 2.099, meaning the S&P 500 is more than two standard deviations above our preferred measure of long-term trend.

Is this a signal? Not on its own. But it’s interesting as we move into a “Fed Week.”

Source: Optuma

Final Thoughts

Stocks are strong—there’s no arguing that. The Fed is expected to cut this week, and likely two more times before year-end. So, where’s the surprise? That’s the real question.

Will this be a textbook case of “buy the rumor, sell the news”? We’ll find out soon enough.

Dan Russo, CMT

READ ALL RESEARCH BY POTOMAC CONTENT HERE.

Disclosure:

Potomac Fund Management (“Potomac”) is an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. Potomac does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Potomac website or incorporated herein, and takes no responsibility for any of this information. The views of Potomac are subject to change and Potomac is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-335-20250915