Cracks in the Facade

October 13, 2025

Over the weekend, I noticed a lot of people suddenly became experts in private credit. This obscure backwater of the financial system has been booming over the past few years, but the $10 billion bankruptcy of a company called First Brands, Inc. has cast a negative spotlight on the space—especially its connection to the high-yield credit markets.

While I find the story fascinating and admittedly spent early morning hours reading articles and listening to podcasts on the drama, we remain focused on the market data, which show some early signs of stress.

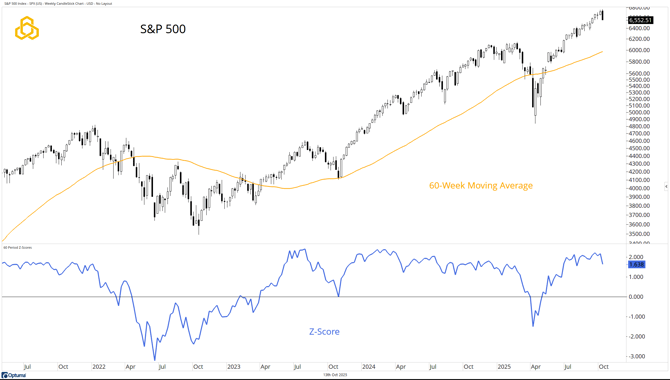

S&P 500

After trading at all-time highs, the S&P 500 reversed to close near the week’s lows. The sell-off alleviated the overbought condition we highlighted last week, but there is still a fair amount of room to the rising 60-week moving average.

Source: Optuma

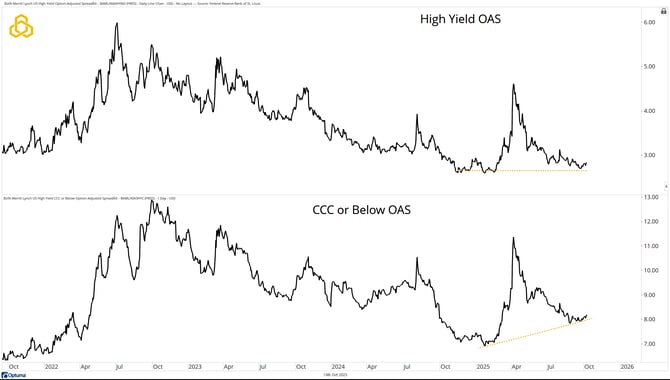

Credit Spreads

Last week, we noted that while high-yield spreads were trading near their lows, the CCC and Below spreads—the “trashiest of the trash”—were making a higher low. For context, First Brands was a CCC credit at the time of its bankruptcy.

Source: Optuma

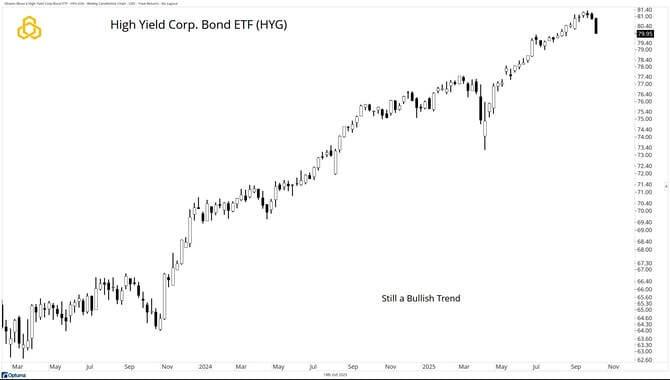

High-Yield Bonds

The iShares iBoxx High Yield Corporate Bond ETF (HYG) closed lower for a third consecutive week. The fund opened near the week’s high and closed near the week’s low. The broader trend remains bullish, but again—a crack in the façade.

Source: Optuma

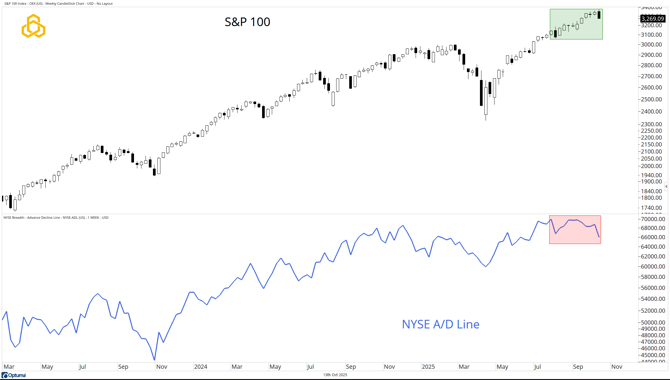

Bringing It Back to Stocks

Similar to the S&P 500, the S&P 100 traded at record levels last week before closing lower. The divergence we highlighted last week remains in place, as weakness in the credit market appears to have triggered some de-risking across the equity landscape.

Source: Optuma

Final Thoughts

I am by no means an expert on private credit, but once again our belief that “if something is important, it will show up in price” has proven true. Last week, we suggested it might be time to tap the brakes based on trends in credit spreads and breadth divergences.

Right now, there are simply cracks. The key will be how quickly those cracks are repaired. If trends recover swiftly, First Brands may prove to be an isolated incident. If not, there could be more downside ahead.

Dan Russo, CMT

READ ALL RESEARCH BY POTOMAC CONTENT HERE.

Disclosure:

Potomac Fund Management (“Potomac”) is an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. Potomac does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Potomac website or incorporated herein, and takes no responsibility for any of this information. The views of Potomac are subject to change and Potomac is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-340-20251010