Give Credit Its Due

October 20, 2025

Last week, at the Potomac Remix Conference, I stood on stage and had to be mostly bullish—for the third consecutive year. And while we still believe that equity markets are somewhat extended from our preferred measures of long-term trend (remember, we tapped the brakes last week because the market may have been a bit ahead of itself), being broadly bullish is objectively the proper stance.

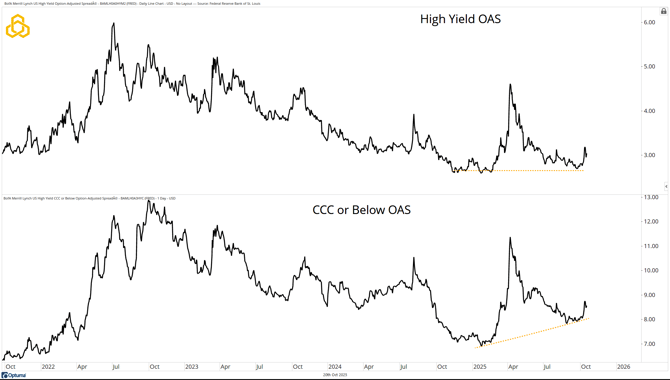

However, there’s one datapoint that’s gnawing at me, and it comes from the credit space. The worst of the worst credits are under pressure, sending spreads in the space higher again last week. Perhaps it’s nothing—but investors must “give credit its due.”

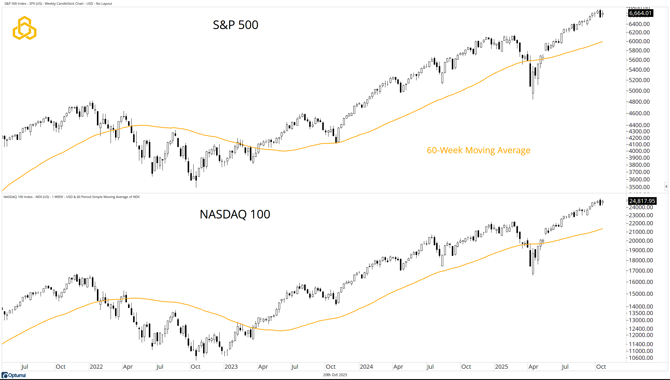

S&P 500 & NASDAQ 100

The two indices most closely followed by U.S. investors are both solidly above their rising 60-week moving averages. Both are trading very close to all-time highs, thus far validating the “tap the brakes” stance.

Source: Optuma

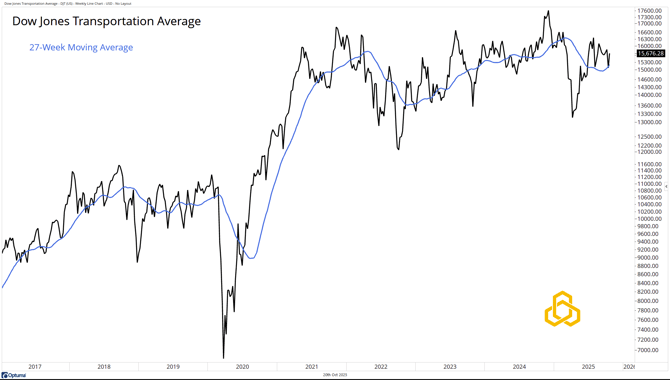

Dow Jones Transportation Average

One of our favorite intermarket themes remains above trend. The Dow Jones Transportation Average, despite moving sideways for the past four-plus years, held the rising 27-week moving average. Yes, we want to see new highs here, but at this point, not breaking down is good enough—especially when this is only one part of a broader composite model.

Source: Optuma

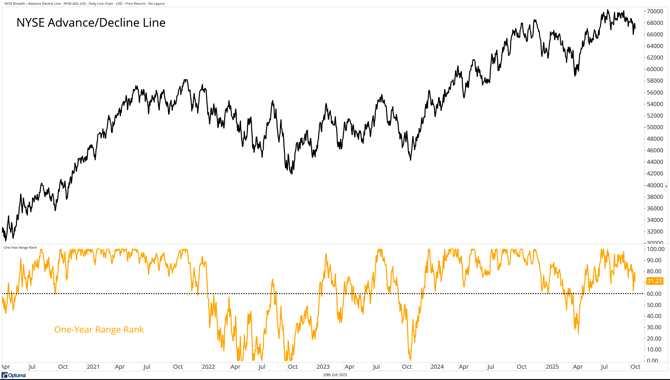

NYSE Advance/Decline Line

The NYSE Advance/Decline Line is showing early signs of weakness, but still not enough to be a major concern. We’ve been pointing out the divergence in this note for the past two weeks, but the one-year range rank is holding above 60%, which is encouraging.![]()

Source: Optuma

Credit Spreads

The High Yield and CCC or Below OAS are not something I ever thought I’d include in a note for three weeks in a row—but here we are. We’ve highlighted the divergence between CCCs and HY, and last week brought a spike in both. This is the area of the market that should be a focus, as spikes here can foretell weakness in the equity market.

Source: Optuma

Final Thoughts

So far, the objective data does not call for a bearish stance on the market. Yes, stocks are still a bit overdone to the upside, but that is not a reason to “get bearish.”

However, we continue to monitor the divergences in breadth and credit spreads. If stress in the credit space persists, it could eventually spill over into equities. For now, the trend remains up—but credit deserves our attention.

Dan Russo, CMT

READ ALL RESEARCH BY POTOMAC CONTENT HERE.

Disclosure:

Potomac Fund Management (“Potomac”) is an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. Potomac does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Potomac website or incorporated herein, and takes no responsibility for any of this information. The views of Potomac are subject to change and Potomac is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-341-20251020