I Spy Another New High

07/21/2025

We’ve been bullish—and right—in these pages for many weeks. During that time, we’ve highlighted the various systems that support our composite models, all of which continue to back a bullish stance on equities. Just as important are the additional trends we monitor. While not part of our core models, these signals offer confirmation and add depth to our understanding of the market environment.

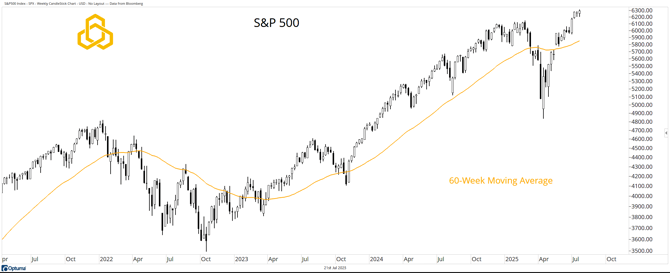

S&P 500

One of our core values at Potomac is to operate under the K.I.S.S. principle, and it doesn’t get much simpler than this: The S&P 500 closed the week at a record high, and it did so above a rising 60-week moving average.

There’s exhaustive research on this topic, and the conclusion is consistent—new highs are bullish and usually shouldn’t be faded.

Source: Optuma

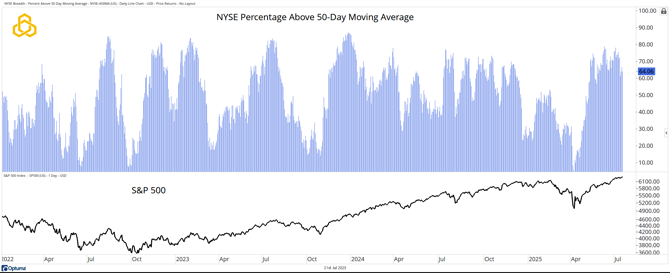

NYSE Percentage Above 50-Day Moving Average

We lean heavily on both trend and breadth analysis. This indicator blends both concepts. Currently, 64% of NYSE-listed stocks are trading above their respective 50-day moving averages—a healthy showing of internal market strength.

Source: Optuma

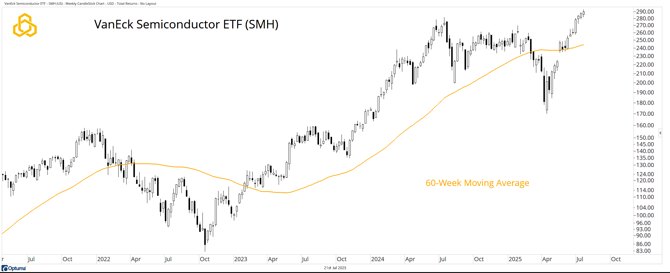

Semiconductors

Long-time readers know I heart semiconductors. I’d go as far as to say the microchip is one of the top three innovations of the past 100 years.

The VanEck Semiconductor ETF (SMH) closed last week at a new all-time high, above its 60-week moving average. It’s also on a seven-week winning streak. Enough said.

Source: Optuma

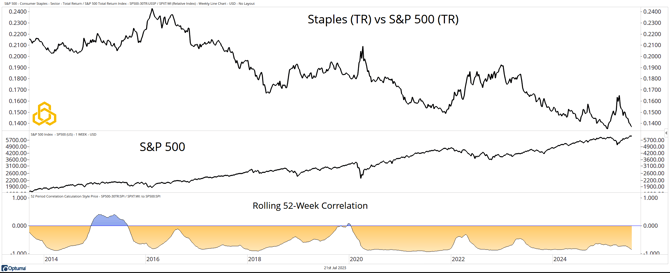

Staples vs. S&P 500 (TR)

The Consumer Staples-to-S&P 500 ratio remains in a clear downtrend. This is what we want to see in a risk-on environment—defensive sectors underperforming the broader market.

When investors are chasing defensives, it’s usually a sign of fear. Right now, they’re clearly not.

Source: Optuma

Final Thoughts

Even if you use other sources of information, the trend is bullish, the trend is healthy based on breadth, and the trend is confirmed by intermarket themes.

VIEW MORE RESEARCH BY POTOMAC CONTENT HERE.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-323-20250721