Keep it Simple & Straightforward

September 22, 2025

Sometimes—very rarely, but sometimes—I think it would be fun to be one of the macro pundits. You’ve all read their work: long weekly missives trying to connect the dots across global asset markets, searching for correlations no one else sees.

Do movements in the Turkish Lira provide a “tell” for Bitcoin? What does the breakdown in the correlation between Wingstop Inc. (WING) and the VanEck Semiconductor ETF (SMH) mean for the broader stock market?

This isn’t a joke—I saw that last one recently and laughed so hard I might have pulled a muscle. When I was done laughing, I came back to one of our core values—the title of today’s note: Keep it Simple & Straightforward.

So, while this might not be the most profound statement on earth, it fits:

Major asset classes are trading at record highs. Record highs are not bearish.

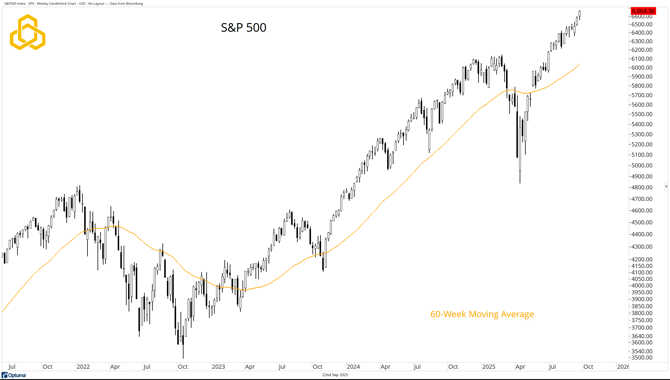

S&P 500

The main index closed higher for a third consecutive week, is trading at record levels, and remains well above the rising 60-week moving average.

Source: Optuma

NASDAQ 100 Index

The NASDAQ 100 Index also closed higher for a third consecutive week, is trading at record levels, and sits above the 10-week moving average, which itself is above the 40-week moving average.

Source: Optuma

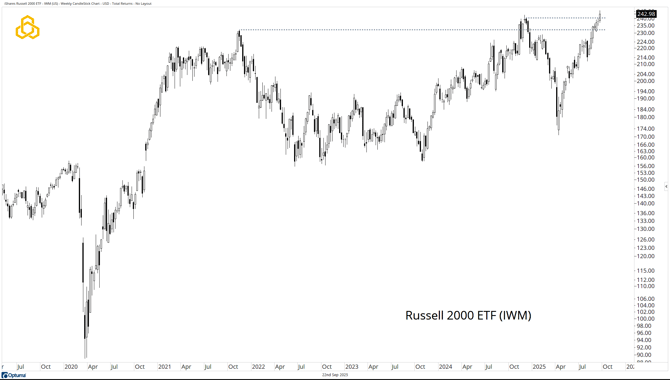

The Russell 2000

The iShares Russell 2000 ETF (IWM) closed higher for a sixth consecutive week. Holding above the $230 level would signal that small caps have completed a nearly four-year consolidation.

Source: Optuma

Junk Bonds

The SPDR Bloomberg HY Bond Fund (JNK) is trading at record highs, above a steadily rising 40-day moving average. The fund is on a seven-week winning streak.

Source: Optuma

Final Thoughts

Sometimes, the best form of analysis is the simplest one—K.I.S.S.

Dan Russo, CMT

READ ALL RESEARCH BY POTOMAC CONTENT HERE.

Disclosure:

Potomac Fund Management (“Potomac”) is an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. Potomac does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Potomac website or incorporated herein, and takes no responsibility for any of this information. The views of Potomac are subject to change and Potomac is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-336-20250922