At the Risk of Sounding Like a Broken Record

September 29, 2025

As the title of the note suggests, I don’t really have anything new to say about the market. I wish I did—it would be great to “call the top” right here in these pages. It would give me bragging rights around here for a long time. But the evidence just doesn’t support making that call. Also, we don’t make calls here, so it’s never going to happen anyway.

The simple fact of the matter is that the trend is up, the trend is healthy, and the trend is confirmed. Additionally, the market is bucking seasonal September weakness.

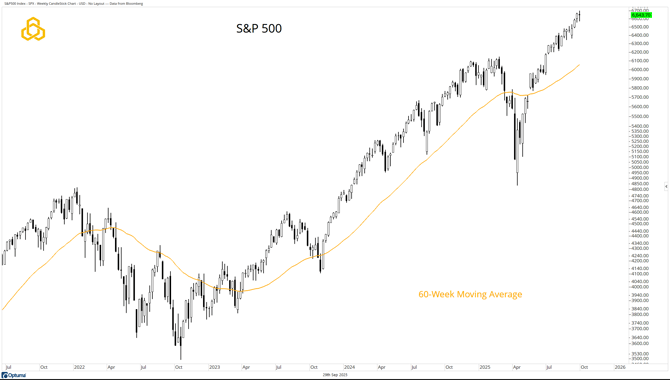

S&P 500

The trend is up. You don’t need the CMT designation to see that. If you were an avid scholar of candlestick patterns, you’d know that last week gave us a doji—a candle where the open and close are roughly equal. After three consecutive positive weeks, this is interpreted as a pause or indecision. Bears will tell you it’s a sell signal, but it isn’t.

Source: Optuma

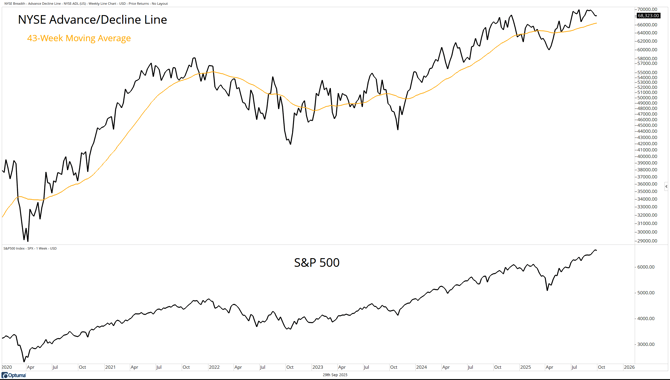

NYSE Advance/Decline Line

If I really wanted to stretch to make a bearish case, this is where I’d start. And in fairness, it bears watching. Yes, the A/D Line is still trending higher above the moving average. But it hasn’t made a new high with price over the past two weeks.

Source: Optuma

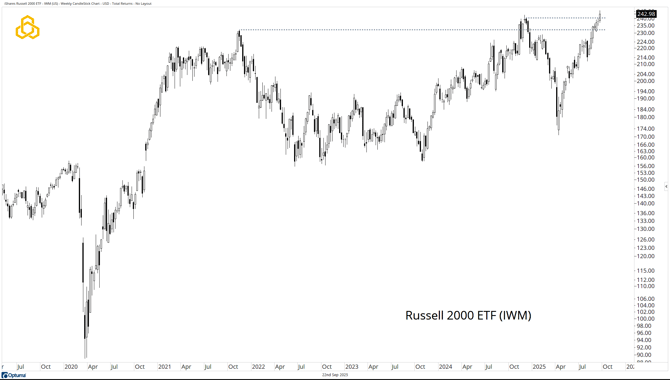

Dow Jones Transportation Average

The Dow Jones Transportation Average is holding above the moving average and remains in a well-established trading range. While bulls want to see a breakout to new highs, the current situation is not bearish.

Source: Optuma

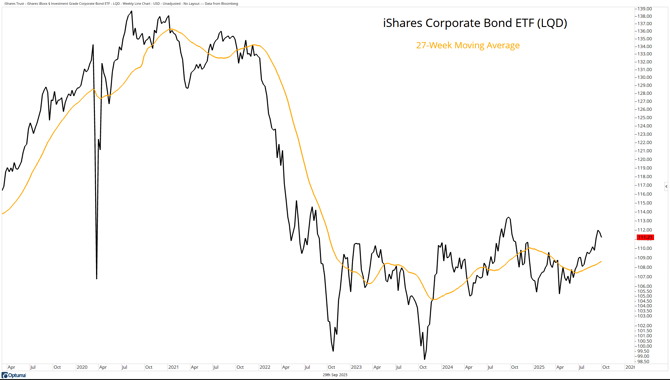

Corporate Bonds

The iShares iBoxx Corporate Bond ETF (LQD) is in the process of reversing weakness from the 2022 selloff. The fund is above the rising 27-week moving average, signaling that the trend is bullish.

Source: Optuma

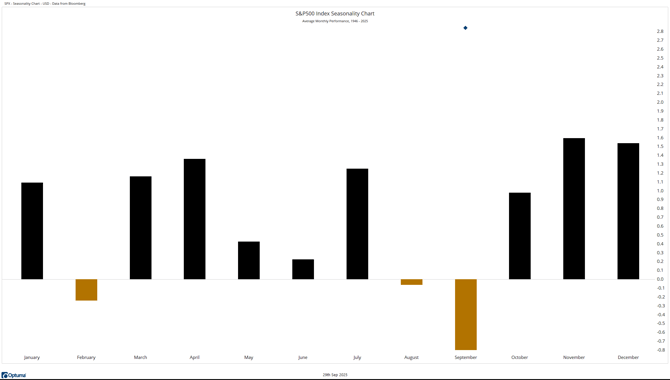

Seasonality

“The market is supposed to go down in September.” At least, that’s what it has done on average since 1950. September is historically the worst month of the year, but in 2025, the S&P 500 has been extremely strong (yes, there are two trading days left).

To be clear, the market has been strong when it’s supposed to be weak. Make of that what you will—but if you try to turn it into a bear case, I’m going to push back.

Source: Optuma

Final Thoughts

There’s no new bearish evidence to lean on. The trend remains up, and the market continues to defy seasonal expectations. While some indicators warrant monitoring, they don’t yet signal a reversal.

So yes, I may sound like a broken record, but that’s what the evidence calls for.

Dan Russo, CMT

READ ALL RESEARCH BY POTOMAC CONTENT HERE.

Disclosure:

Potomac Fund Management (“Potomac”) is an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. Potomac does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Potomac website or incorporated herein, and takes no responsibility for any of this information. The views of Potomac are subject to change and Potomac is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-337-20250929