Maybe a Little Too Quiet

July 28, 2025

It’s summer. And it seems like nearly everyone in the market is in relaxation mode. “Set it and forget it” passive flows continue to provide a steady bid to equity prices, while earnings season is giving more discerning investors reasons to stay engaged.

The net result? The S&P 500 closed at yet another record high—but that’s nothing new. What might be more interesting is that the equal-weight version of the index also closed the week at a new high.

It’s not just the Mega caps doing the heavy lifting. There’s meaningful participation deeper in the cap structure. It’s quiet out there… and if you look at the VIX, it might be a little too quiet.

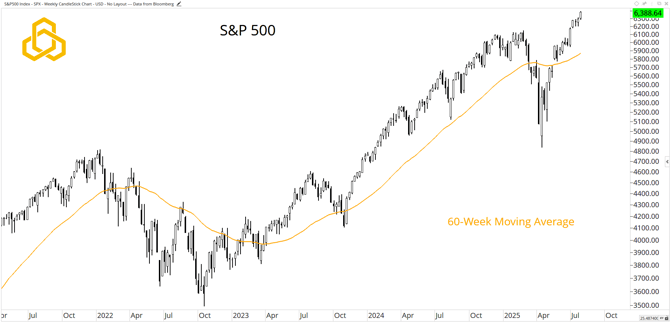

S&P 500

Truthfully, I’m running out of ways to say the same thing week after week:

- The index is in an uptrend.

- New highs are bullish.

- The moving average is rising.

These are just facts—and who am I to argue with them?

Source: Optuma

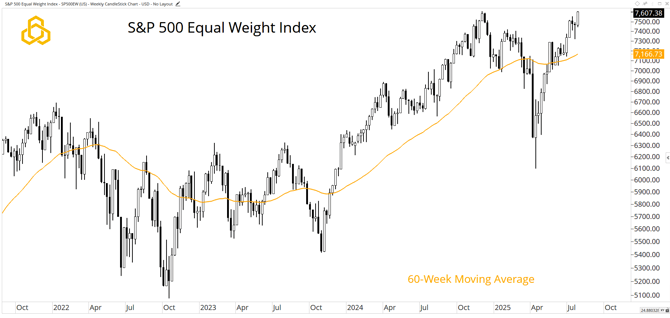

S&P 500 Equal Weight Index

While most of our focus is on the cap-weighted S&P 500, the equal-weight version offers a valuable check on breadth. And this week, it closed at a new high as well.

That tells us the rally is broad-based, with participation extending well beyond the biggest names. It's a different lens on the same bullish breadth we’ve been highlighting for weeks.

Like its cap-weighted cousin:

- The index is in an uptrend.

- New highs are bullish.

- The moving average is rising.

Source: Optuma

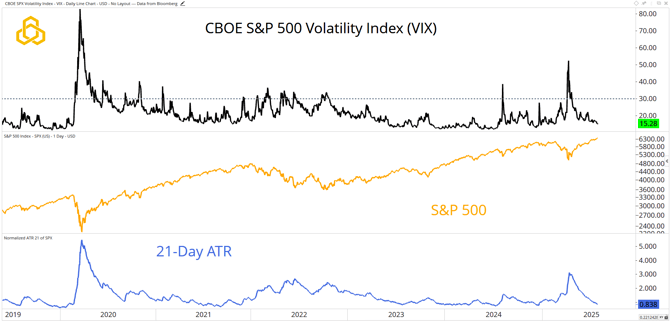

The VIX

The CBOE S&P 500 Volatility Index (VIX) closed the week below 16. Let’s be clear—low volatility is not a sell signal. But it does tell us something: there’s very little fear priced into the market right now.

The closing level of 15.22 implies that the market is expecting ~0.95% daily moves over the next month. For context, the 21-day Average True Range (ATR) suggests the market has been realizing ~0.85% daily moves.

In short:

- It’s quiet.

- And investors expect it to stay quiet.

Source: Optuma

Final Thoughts

There’s not much new to say—sleepy summer trading is unfolding in the direction of the prevailing trend, pushing key indices to record levels.

Higher prices are driving fear out of the market. That’s not negative on its own. But let’s be clear: the bullish narrative is no longer a secret.

You know it.

I know it.

Everyone knows it.

VIEW ALL RESEARCH BY POTOMAC CONTENT HERE.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-324-20250728