More of the Same?

November 3, 2025

It’s beginning to look a lot like Groundhog Day! I know—it’s not as catchy as the true holiday original, but we deal in facts here… and those are the facts. The S&P 500 and NASDAQ 100 closed the month of October at all-time weekly highs. November kicks off the “best six months of the year” for the stock market. Breadth, while not confirming, is still fine. Treasury volatility is falling off a cliff.

S&P 500 & NASDAQ 100

The two major U.S. indices—the ones everyone tracks—closed at record weekly highs to end October. What’s more impressive is that they gapped higher, meaning that on Monday morning, demand so outstripped supply that the market had to jump to a new equilibrium level. Both remain well above their rising 60-week moving averages.

.png?width=670&height=380&name=1%20-%20SPX%20(5).png)

Source: Optuma

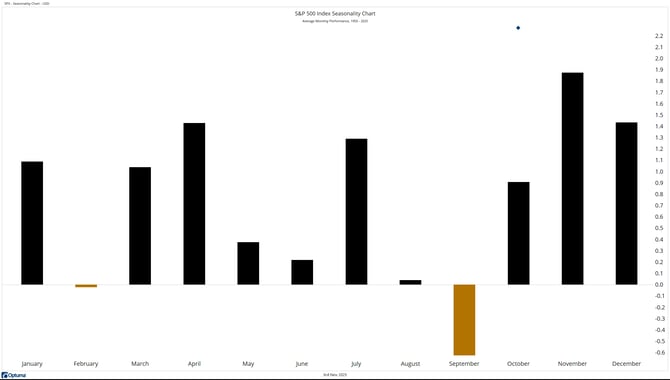

'Tis the Season

With the major averages trading at record levels, the best six months of the year begins for the S&P 500.

Source: Optuma

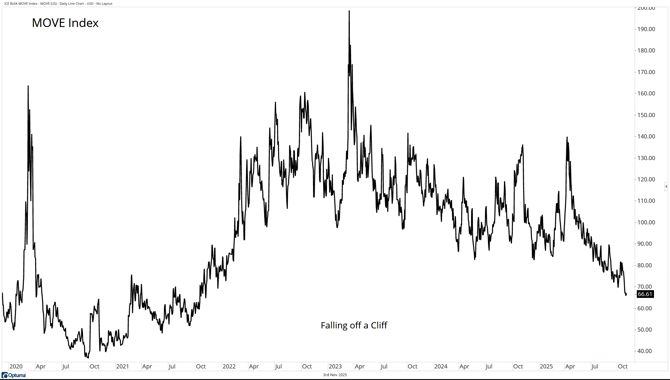

The MOVE Index

For those who don’t know, the MOVE Index is the VIX for Treasuries. It’s falling off a cliff, normalizing after the major spike in 2022 and early 2023. This is an encouraging development for investors who incorporate Treasuries into their portfolios as a diversifier/hedge.

Source: Optuma

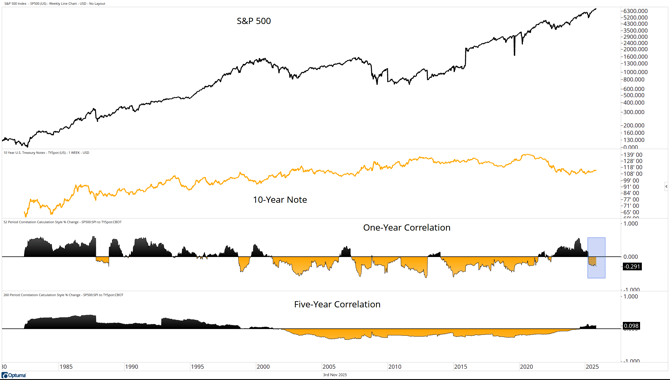

Stock/Bond Correlation

As mentioned above, falling Treasury volatility is a positive for investors who use Treasuries as a diversifier/hedge. Note that the one-year correlation between stocks (S&P 500) and Treasuries (10-Year Note) has turned negative again.

Source: Optuma

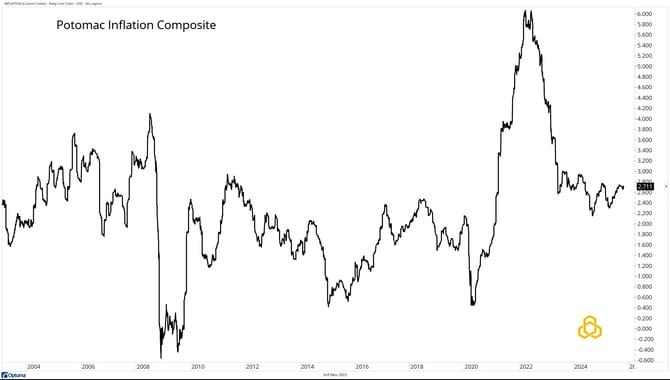

Why? It's All About Inflation Expectations

As systematic investors, we don’t usually concern ourselves with “the why.” But sometimes it’s fun to talk narrative. As we’ve been saying for a while, the why for all of this is inflation—or more precisely, the belief that inflation is under control. In fact, our inflation composite, which is a blend of three different inflation metrics (CPI, 5-Year/5-Year Forwards, 10-Year/10-Year Forwards), is sitting below the reported CPI.

Final Thoughts

Stocks enter the best six months of the year in a bullish position. Treasury volatility is falling, reinforcing the case for diversification with bonds. The key driver behind all of this is dampened inflation expectations.

Until that changes, expect more of the same.

Dan Russo, CMT

READ ALL RESEARCH BY POTOMAC CONTENT HERE.

Disclosure:

Potomac Fund Management (“Potomac”) is an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. Potomac does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Potomac website or incorporated herein, and takes no responsibility for any of this information. The views of Potomac are subject to change and Potomac is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-343-20251103