No Fright in This Tape

October 27, 2025

As we move into the final week of October—culminating with Halloween on Friday—there’s little to no fright in the market. The short-lived, credit-induced blip from two weeks ago seems to be forgotten. Last week’s CPI print came in cooler than expected, making it hard to believe the Federal Reserve will reverse course on its rate-cutting cycle. Meanwhile, the market generals are leading, and the troops are following. What’s the bear case here?

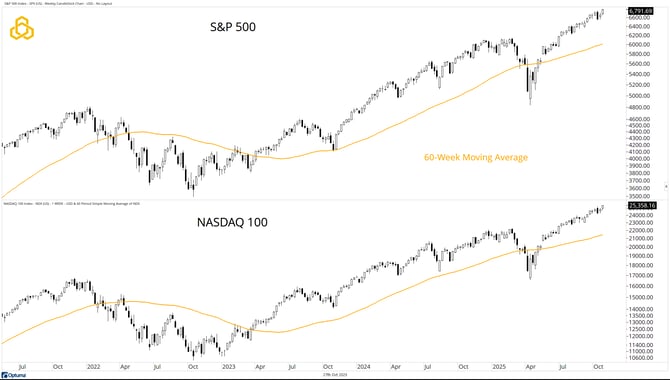

S&P 500 & NASDAQ 100

The two most widely followed markets in the United States closed at record highs last week. Both remain well above their respective 60-week moving averages, which are also at record highs

Source: Optuma

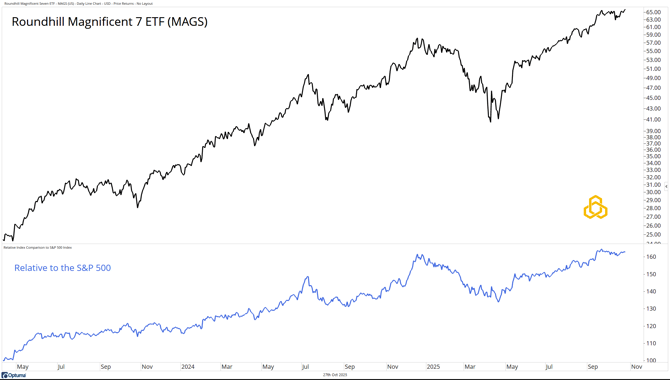

The Mag 7

The generals are leading—and that’s a good thing. The Roundhill Magnificent 7 ETF (MAGS) is trading at all-time highs on an absolute basis and near record levels relative to the S&P 500.

Source: Optuma

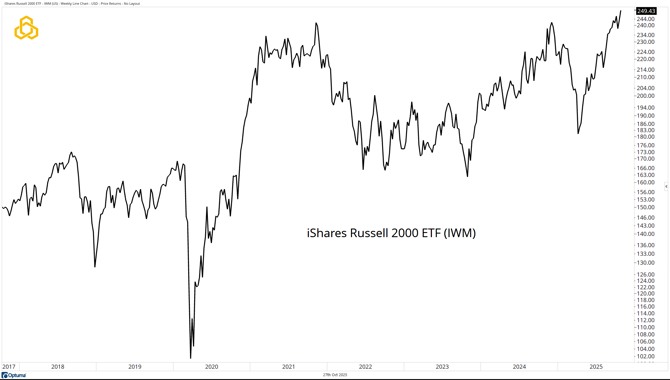

Russell 2000

While it’s encouraging to see the generals leading the charge, it’s perhaps more interesting that the “troops” are following them into battle. The iShares Russell 2000 ETF (IWM) closed the week at an all-time high, breaking out from a nearly four-year consolidation. Those who argue that market strength is merely a function of the top seven names are either lazy or lying to you.

Source: Optuma

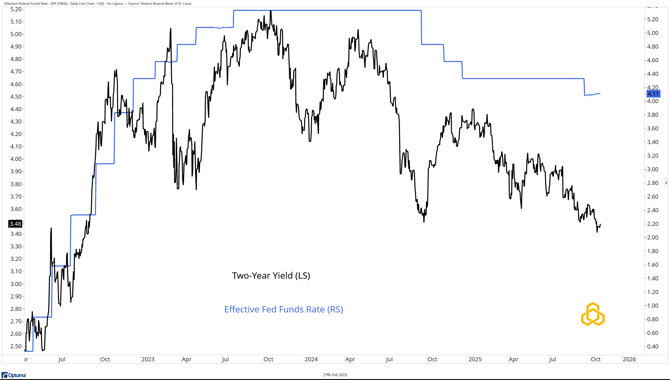

The Fed Still Has Air Cover

The Federal Reserve still has cover to continue its rate-cutting path. Last week’s CPI report came below expectations and showed no meaningful rise in inflation. The current Effective Federal Funds Rate sits at 4.11%, while the Two-Year Yield is at 3.48%—a delta of 63 basis points, keeping the odds of two cuts by year-end high.

Source: Optuma

Final Thoughts

With the S&P 500 and NASDAQ 100 trading at record levels, and participation in the rally broad-based—both the “generals” and the “troops” are marching into battle for the bulls. At the same time, the bond market continues to provide cover for the Federal Reserve to cut rates twice by year-end.

To be bearish here is to fight both the tape and the Fed. That seems to be the more frightening proposition.

Dan Russo, CMT

READ ALL RESEARCH BY POTOMAC CONTENT HERE.

Disclosure:

Potomac Fund Management (“Potomac”) is an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. Potomac does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Potomac website or incorporated herein, and takes no responsibility for any of this information. The views of Potomac are subject to change and Potomac is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-341-20251027