One Week Does Not Make a Trend

August 4, 2025

Last Thursday morning, as the market was trading higher on the back of earnings reports from Meta Platforms, Inc. (META) and Microsoft Corp. (MSFT), I looked under the hood and realized that while the S&P 500 was strong, there were a lot more stocks trading lower than higher. In our group chat, I made the comment, “Today is going to be one of those days that everyone tells you how bad breadth is.”

The market promptly turned lower and closed down for the week. Now, one week does not make a trend, but further weakness in breadth would be a concern by our work.

S&P 500

To be clear, the index is still in a bullish trend above a rising 60-week moving average. But we would be lying if we said that last week’s trading was not a wake-up call. The index traded to a new high, reversed, and closed near the low of the week. A quick rebound here, and all is forgiven, but further weakness below 6,100 would be a concern.

.png?width=670&height=290&name=1%20-%20SPX%20(1).png)

Source: Optuma

NYSE Advance/Decline Line

The NYSE Advance/Decline Line turned lower for the week. What the bulls do not want to see is a market where only the mega caps are rallying on earnings while the rest of the market, especially cyclicals, are trading lower. For instance, the Materials sector traded off by more than 6% last week. This divergence is concerning.

Ideally, we see a quick rebound in the market with broader participation driving the one-year stochastic back above 80.

.png?width=670&height=290&name=2%20-%20ADLINENYSE%20(1).png)

Source: Optuma

Growth vs. Value

I noted above that the cyclical Materials sector was off by more than 6% last week. At the same time, the ratio of large growth stocks to large value stocks trades near its highs.

Why does this matter? I am a firm believer that when investors are concerned about slowing growth, they are willing to pay up for stocks that exhibit growth. The strong performance of the ratio could be a signal that investors are concerned about economic growth.

.png?width=670&height=290&name=3%20-%20Growth%20vs%20Value%20(1).png)

Source: Optuma

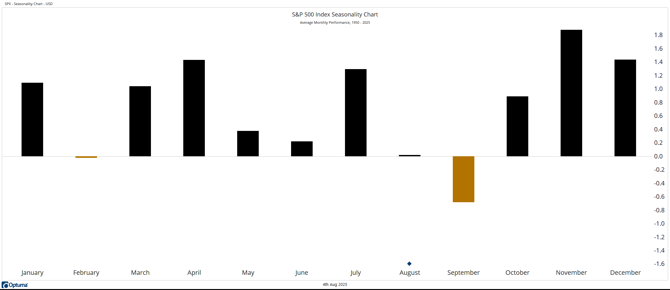

Seasonality

These internal dynamics are surfacing as we enter the historically soft August-September period. Since 1950, August has tended to be flat, while September has reliably skewed negative.

Source: Optuma

Final Thoughts:

One week does not make a trend; however, we are risk managers first and foremost. It is our job to look at all the angles, and right now there are some data points that need to be watched closely.

Dan Russo, CMT

READ ALL RESEARCH BY POTOMAC CONTENT HERE.

Disclosure: This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page.

PFM-358-2025-804