Perhaps a Tap on the Brakes

October 6, 2025

The S&P 500 closed at another record high last week as investors continue to ignore the “thematic” risks that the media loves to highlight. The most recent risk? A potential government shutdown. Themes and narratives are great for clicks, but price trends and data are the true raw materials of investing.

As the fourth quarter gets underway, market data remains bullish. The only real argument against the market is that it’s extended to the upside and there’s a slight divergence between price and breadth. As tactical managers, these are dynamics that hit our radar in one form or another.

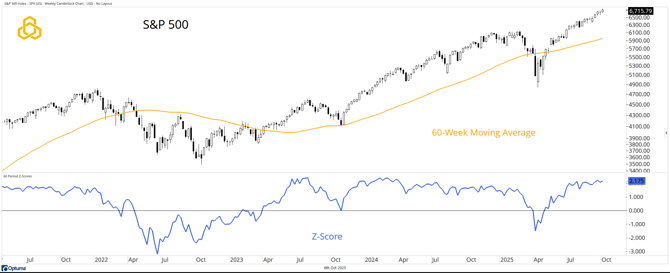

S&P 500

As stated, the S&P 500 set another record last week. The index is at all-time highs above the rising 60-week moving average. It’s hard to argue with record highs, other than to say the market is “extended” above the moving average. The 60-week Z-score sits at 2.175—more than two standard deviations above the moving average. Does this mean the market has to crater from here? No, but it’s a logical spot to pause.

Source: Optuma

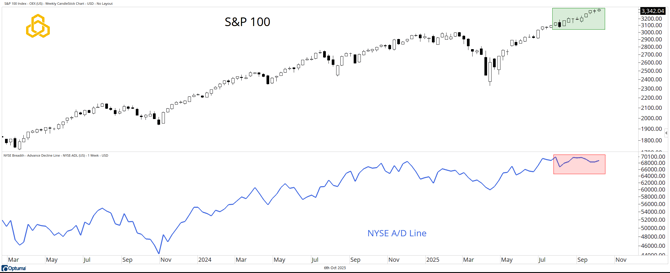

S&P 100 and NYSE Advance/Decline Line

Like the more widely followed S&P 500, the S&P 100 Index trades at record levels. Again, it’s hard to argue with record highs, but as risk managers, we’re mindful of the slight divergence in place.

The record highs for the index have not been matched by new highs in the Advance/Decline Line. The divergence is slight, but it has persisted since July.

Source: Optuma

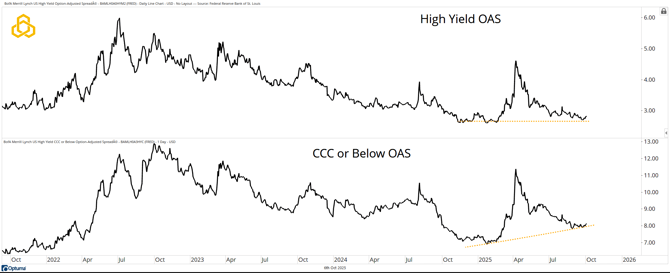

Credit Spreads

The divergence between price and breadth isn’t the only one on our radar. The High Yield Option-Adjusted Spread (OAS) is trading near the lows reached in October 2024 and early 2025. However, the CCC and Below OAS have not reached those prior lows.

Said differently, the spreads in the riskiest credits are not as tight as the high yield spreads.

Source: Optuma

Final Thoughts

It’s hard to be overly bearish given the strength in price trends across key market averages. But as risk managers, we must remain alert to what’s happening beneath the surface.

Not all divergences lead to sell-offs—but many sell-offs begin with divergences. With the market extended and some internals flashing caution, a tap on the brakes may be warranted.

Dan Russo, CMT

READ ALL RESEARCH BY POTOMAC CONTENT HERE.

Disclosure:

Potomac Fund Management (“Potomac”) is an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. Potomac does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Potomac website or incorporated herein, and takes no responsibility for any of this information. The views of Potomac are subject to change and Potomac is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-339-20251006