The Market Is Not the Economy

September 8, 2025

I feel like I burst a lot of bubbles last week. It was back-to-school week. I teach a college class on market analysis (mostly technical), which is part of the Finance & Economics Department at the school. My students are all seniors, mostly finance majors. They’ve taken all the traditional classes—they’ve learned about fundamentals, valuations, and even had the misfortune of learning how to build a discounted cash flow analysis.

Then they get to my class, where I open by telling them that for traders and investors, the only thing that matters is price. I tell them, “the stock is not the company.” I go through a number of reasons and examples to support this claim, and I can see half the class become dejected (did they just waste four years learning how to build financial statements? I assure them the answer is no). The other half of the class becomes excited. These are usually the students flipping crypto while I’m teaching (for the record, I don’t frown upon this).

Last week, the nonfarm payrolls report missed expectations, and the prior month was revised into negative territory. The Fed is likely to cut rates in September. Reading that last sentence, one might assume the economy is on shaky ground and the stock market is in a precarious spot… one would be wrong.

Just as the stock is not the company, the market is not the economy.

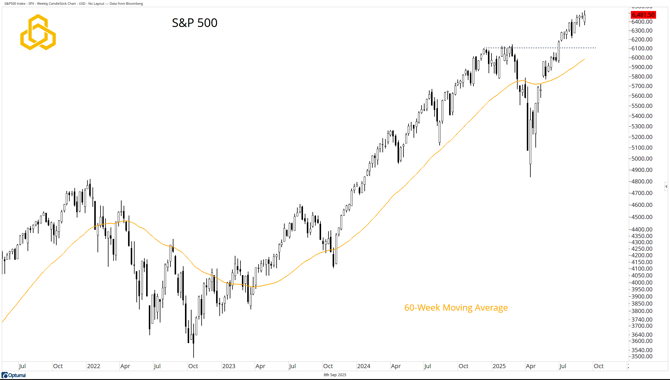

S&P 500

The most widely followed index on the planet traded at a record high last week and remains above the steadily rising 60-day moving average. Price support at 6,100 is still valid.

Source: Optuma

Sector Returns

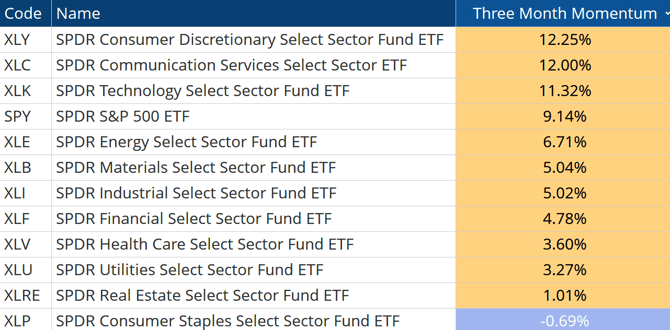

Of the 11 sectors of the S&P 500, only one has been down over the past three months. On top of that, the most important market sectors are all leading.

The one loser? Staples—a defensive group. The bottom of the list also includes Real Estate, Utilities, and Health Care… all defensive groups.

Source: Optuma

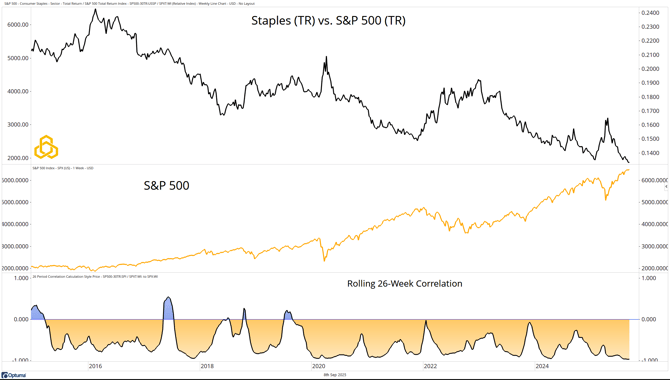

Consumer Staples vs. S&P 500

Looking at the total return ratio of the Consumer Staples sector vs. the S&P 500 on a weekly basis, we see new relative lows.

We can also see that the rolling 26-week correlation has been mostly negative—meaning that as the ratio falls, the S&P 500 usually rises.

Source: Optuma

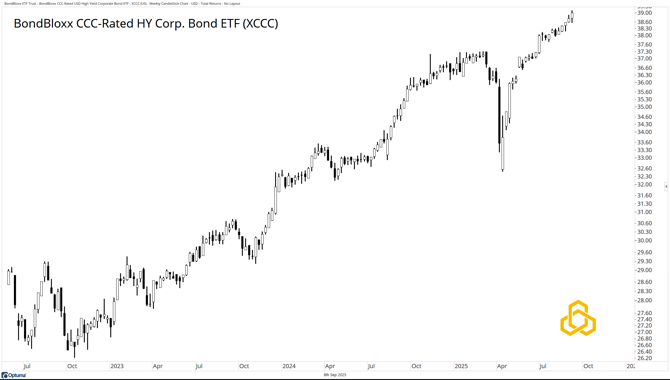

Junk Bonds

Finally, if we look at junk, we see new highs. But this isn’t just regular junk—this is a chart of the BondBloxx CCC-Rated HY Corp. Bond ETF (XCCC). This is the lowest-rated junk—the junkiest of the junk.

Source: Optuma

Final Thoughts

Despite signs of economic softness—like a weak jobs report and rising expectations for a Fed rate cut—the market continues to show strength. The S&P 500 is trading at record highs, key sectors are leading, and defensive groups are lagging. Technical indicators remain supportive, and even the lowest-rated junk bonds are hitting new highs.

The takeaway: price is the ultimate truth. Just as the stock is not the company, the market is not the economy.

Dan Russo, CMT

READ ALL RESEARCH BY POTOMAC CONTENT HERE.

Disclosure:

Potomac Fund Management (“Potomac”) is an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. Potomac does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Potomac website or incorporated herein, and takes no responsibility for any of this information. The views of Potomac are subject to change and Potomac is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-334-20250908