You Can't Argue with New Highs

August 18, 2025

Last week, we highlighted Bob Farrell’s 10 Rules for Investors, with particular attention to rule number seven: Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names. In other words, breadth matters — bulls want to see broad participation in uptrends. We were careful to note that there was no immediate cause for alarm.

This week, we turn to another timeless truth: you can’t argue with new highs. And there are quite a few worth noting.

S&P 500

The S&P 500 continues its relentless march higher from the April lows, reaching a new all-time high last week above a steadily rising 60-week moving average. Notably, the index closed the week at the top of its range — a sign that investors were willing to “go home” long equities.

.png?width=670&height=300&name=1%20-%20SPX%20(3).png)

Source: Optuma

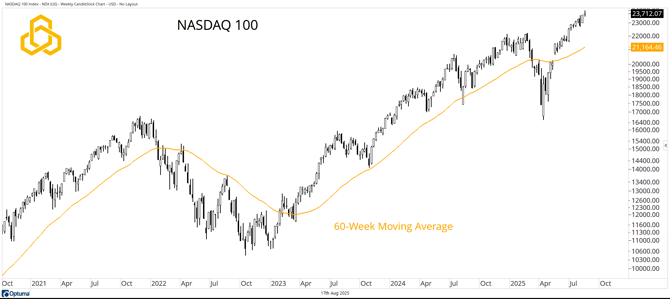

NASDAQ 100

The NASDAQ 100 Index also traded to a new record high last week and remains well above its rising 60-week moving average. While it didn’t close at the top of its weekly range, it did register a new weekly closing high — surpassing the prior week’s record.

Source: Optuma

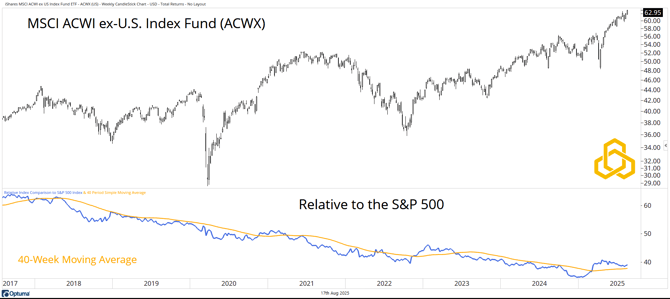

Rest of the World

U.S. investors tend to maintain a disproportionate allocation to domestic equities — a well-documented phenomenon known as “home country bias.” Over the past decade and a half, that bias has served them well, as U.S. markets have dominated global performance.

But it may come as a surprise that the MSCI ACWI ex-U.S. Index Fund (ACWX) is now in a strong uptrend. The fund ticked to a new high last week and, like the S&P 500, closed at the top of its range.

While the new highs are noteworthy, we’re even more interested in the relative performance. ACWX is quietly attempting to reverse a long trend of underperformance and is holding above a flat 40-week moving average. It’s early days, but we’re intrigued. One could argue that the average U.S. investor is not positioned for a period of sustained outperformance by the rest of the world.

Source: Optuma

Final Thoughts

Key market measures closed last week at new highs. In the U.S., much of the attention will center on the S&P 500 and NASDAQ 100 — and rightly so. But we would be remiss not to highlight that the “rest of the world” is participating as well. More than that, it’s attempting to reverse a long-standing trend of underperformance. If it succeeds, many investors may find themselves caught off guard.

Dan Russo, CMT

READ ALL RESEARCH BY POTOMAC CONTENT HERE.

Disclosure:

Potomac Fund Management (“Potomac”) is an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. Potomac does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Potomac website or incorporated herein, and takes no responsibility for any of this information. The views of Potomac are subject to change and Potomac is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-331-20250818